How to Start and Run a Profitable Small Business

A Step-by-Step Online Course for Entrepreneurs

Are you ready to start your own business but unsure where to begin? This self-paced online course provides step-by-step guidance to help you turn your dream into a profitable reality.

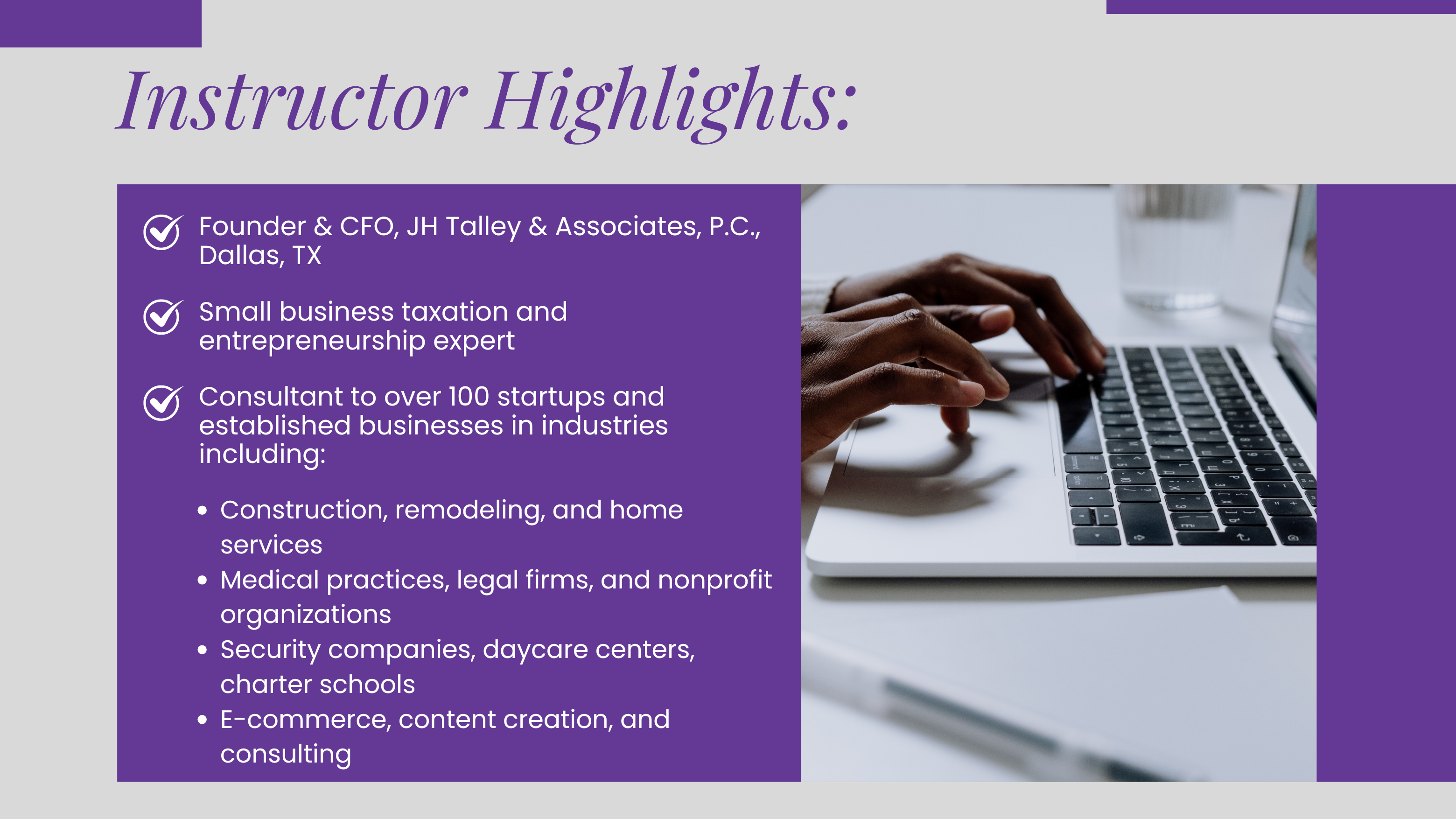

In this practical and spiritually grounded course, you’ll be guided step-by-step through the critical phases of launching and sustaining a successful small business. Drawing on the wisdom and technical insights of James H. Talley, the course equips aspiring entrepreneurs with tools, frameworks, and checklists to steward resources wisely and profitably.

You’ll learn how to measure your readiness, design a robust business plan, choose the right legal structure, understand financial reports, navigate taxation, market your business, and scale it sustainably. Each module includes real-world applications, downloadable templates, and personalized reflection opportunities.

You’ll learn how to plan, launch, fund, and grow a sustainable business—while managing risk and honoring biblical principles of stewardship, diligence, and excellence.

Self-Paced & Accessible – Learn on your schedule, from any location

Expert-Led Training – Gain insights from a seasoned CPA and business consultant

Practical & Actionable – Apply proven tools and checklists immediately

Downloadable Resources – Business plan templates, tax checklists, startup budgets, and financial worksheets

Certificate of Completion – Enhance your resume or secure funding with proof of training

This 12-module, self-paced course walks you through every stage of business development—from concept to launch to growth. It provides a clear roadmap grounded in real-world practice and timeless biblical principles. By the end of this course, you will be able to:

Evaluate your entrepreneurial traits and readiness

Write a comprehensive business plan

Choose the appropriate legal structure for your business

Understand tax responsibilities and recordkeeping

Create a feasible financial plan

Develop and implement a promotional strategy

Protect your business with appropriate risk management

Explore franchising as a business model

Identify sources of help and funding

Aspiring entrepreneurs looking to launch with clarity and confidence

Small business owners seeking growth and better financial management

Home-based and online business founders

Retirees, recent grads, and second-career professionals

Aspiring entrepreneurs

Retirees launching second careers

Minority business owners

Home-based and micro-business startups

Students seeking an applied entrepreneurship foundation

Welcome to Starting Your Own Business

Quick Check: Activate Your Thinking

Choose each statement with the right concept

Your Entrepreneurial Journey Begins Here

Quick Check: Activate Your Thinking

Choose each statement with the right concept

From Statistics to Significance: Your Role in the Bigger Picture

Lesson 1: What Is Entrepreneurship?

Definition

Entrepreneurship vs. Employment

Entrepreneurship Begins with Willingness

Reflection

Lesson 2: Why Small Businesses Matter

Small Businesses: The Backbone of the Economy

Local Impact, Global Influence

Reflection

Lesson 3: Traits of Successful Entrepreneurs

The Entrepreneurial Mindset: What Sets You Apart

Top Traits of Successful Entrepreneurs

Growth Comes with the Journey

Real Talk: You Don’t Need to Be a Superhero

Reflection

Lesson 4: Your Entrepreneurial Motivation

Digging Deeper: The Power of Knowing Your ‘Why’

Common Motivations for Starting a Business

More Than Profit: Build with Purpose

When Your ‘Why’ Gets Tested

Reflection

Lesson 5: Are You Ready?

Entrepreneurial Readiness Isn’t About Having It All Figured Out

The “Am I Ready?” Checklist

Growth Begins with Honest Reflection

Download: Module 1 Readiness Checklist

Reflection

End-of-Module: You’ve Laid the Groundwork

Don’t let uncertainty delay your dream. Gain the tools, confidence, and community you need to launch your business and walk in your calling.

Your Business. Your Purpose. Your Success.